Weekly Italpreziosi Report – October 9-13

Weekly Italpreziosi Report – October 9-13

Report settimanale 9 – 13 Ottobre

The week has been characterized by the interventions of the central bankers. On Wednesday the minute of the FED has been published and comes to the light the conflicting opinions inside the board of the American Central Bank respect the inflation. In fact, the components of the federal Committee of the open market have expressed some doubts about the fact that the low rate of inflationary growth is not only a temporary phenomenon but, contrarily, a phenomenon of long duration that could persist more than the expectation. The prudent behavior of the FED has been seen by the markets as a sign of indecision and uncertainty: this have put the dollar under pressure recording from the Bloomberg dollar index the fifth consecutive session in red. The euro has been the one who profit mostly from this situation concerning the weakness of the dollar and has grown till touching quota 1.189 helped by the fact that the smaller fears on the independence of the Catalogna are going to turn off.

Thursday has been the turn of the European Central Bank. The number one Mario Draghi said that he is satisfied of the easy-going monetary politics till now pursued by the institute of Frankfurt and has reassured the markets promising that the rates of interest will remain at today's levels for a lot of time. Draghi, that has spoked at the Peterson Institute of Washington in occasion of the autumn meeting of the International Monetary Fund and the World Bank, have affirmed that the positive effects brought by the quantitative easing have been more positive than the negative ones . The only negative things are the salaries, which growth is not as expected. During this week some indiscretions as Bloomberg said- about the tapering have emerged -: the BCE would be studying some actions to put the end (very gradually) to the program of purchase of sovereign bond and corporate. At the moment nothing is sure but is possible that some indiscretions has slip out awareness with the only purpose of see how the markets would have reacted to the news.

In the meantime the stock indexes continues inexorable to grind new records and they don't seem to be worried about the future holds concerning the monetary politics. The s & P500 is faround 2550 points while the DAX has broken down the wall of the 13.000 and it travels toward the 13.050. The gold, that has profited of the weakness of the dollar after the drafts of the FED, is stable in area 1290 $ /oz.s.

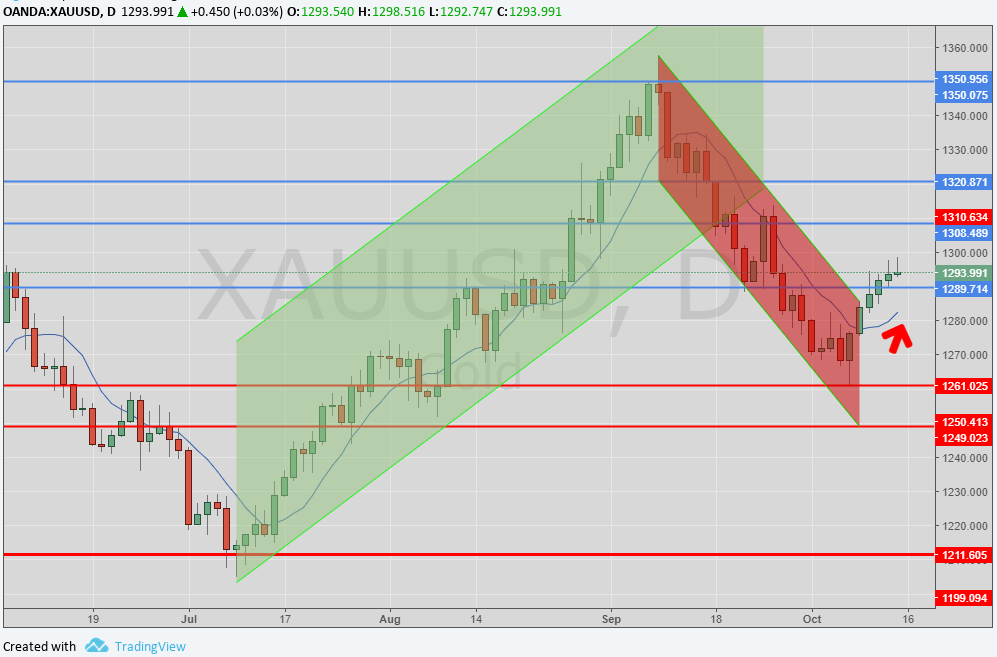

GOLD (XAUUSD)

After four consecutive weeks in red the gold is going to close the final week of the stock exchange in a positive territory. As mentioned before, the metal exploited the shakings of the FED around the monetary politics. The range of price in which the quotations have fluctuated has been around 20 dollars (1280. 1300). Such movement has been enough to puncture the descending channel in which the metal was inserted in the last four weeks. The principal driver still the dollar and, accordingly, the future movements of the FED concerning the rates of interest. On the political front, the phase of stalemate that are currently crossing the bargaining among United Kingdom and Europe on the Brexit seem to be a valid driver for the purchases.

Daily graphic XAUUSD (principals supports e resistance)

Silver (XAGUSD)

The silver has followed the gold perfectly reflecting the rebound of the yellow metal. After be supported in area 16,50 $ / oz the silver has bounced till go to resistance in area 17.20. Also in this case the principal driver for the quotations is the dollar. Supports and resistance visible on the graphic.

Daily graphic XAGUSD (principals supports e resistance)

PLATINUM(XPTUSD)

During the week the price of the metal has bounced from the strong support positioned in area 910 $ /oz.s Nevertheless the quotations of the metal keep on being inferior to those of the palladium. The platinum as the whole compartment of the jewels, seem to went out of a descending trend and is going to test the resistance in area 961 dollars per ounces. The supports and the resistances are visible on the graphic.

Daily graphic XPTUSD (principals supports e resistance)

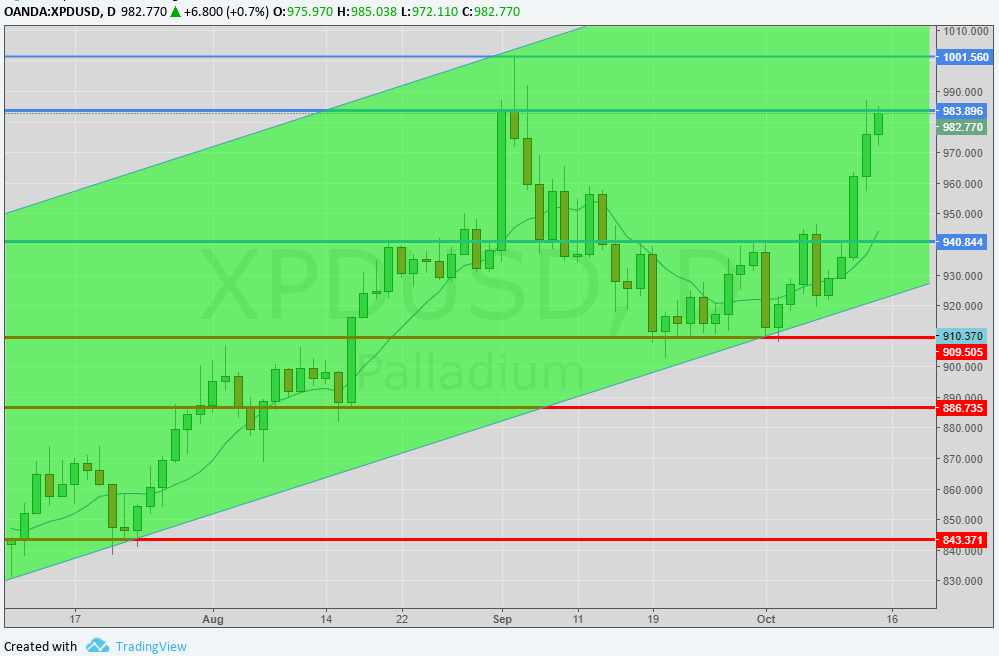

PALLADIUM (XPDUSD)

The palladium keeps on running towards the up demonstrating more stronger than the other jewels. Currently the metal is close to the to the maximum touched in September push from the good records about the sales of cars in China. As the good fundamental (less offer and more question) grown the possibilities around an another test of the maximum in area 1000 dollars per ounces. As already anticipated, the spread with the platinum would be able to rebalance in favor of this one pushing to the rebate the quotations in the middle term (3. 6 months).

EURODOLLAR(EURUSD)

The change has returned to the increasing channel after having taste the area behind 116. The value of the eurozona has earned strength towards the dollar after the recent comments of the FED concerning the inflation. In the last three months the trading range has been enough narrow and the change hardly trying to move away from the area 1,17-1.20. probably a certain directionality will be defined from the beginning of the next meeting of the BCE scheduled at the end of October. The Euro one as the jewels, doesn’t seem to have felt the effect from the announcement of a next rise of the rates from the FED scheduled for the December.

Daily graphic EURUSD (principals supports e resistance)

…IN BRIEF

|

GOLD |

Resistance |

1280 |

1290 - 1310 |

|

Supports |

1260 |

1215 - 1225 |

|

SILVER |

Resistance |

17,25 |

17,70 |

|

Supports |

15,60 - 16,15 |

16,65 |

|

PLATINUM |

Resistance |

1032 |

1045 - 1050 |

|

Supports |

960 |

980 - 986 |

|

PALLADIUM |

Resistance |

940 |

985 - 1000 |

|

Supports |

910 - 912 |

900 |

|

EURUSD |

Resistante |

1,18 - 1,20 |

1,25 |

|

Supports |

1,15 - 1,16 |

1,175 |

Fonti: Bloomberg, Commerzbank, Reuters, UBS.

Finito di redigere alle 15:30 di venerdì 13 ottobre 2017.

IT

IT  ES

ES