Weekly Italpreziosi Report – 25-29 september

Weekly Italpreziosi Report – 25-29 september

WEEKLY REPORT SEPTEMBER 25-29

The last week has been opened with the result of the German federal elections: as expectation, Angela Merkel has gone out as a winner and it is going to cover its fourth political mandate. Nevertheless, in the recent round of elections the

chancellery must go down to compressed with the counterparts having captured only a one third of the votes. The impact on the markets had an effect on the change Eurodollar that has lost points from the recent maximum. The European lists, after a beginning of the week weak, have greeted positively the Merkel’s win and they have proceed on grinding new maximum. The important appointments however have not been exhausted with the German elections: the week has seen. practically every day. the intervention of a central banker.

From Draghi (BCE) TO Yellen (FED), passing for Carney (BoE) and Poloz (BoC), what has put in common all the interventions has been the very prudent tone: the data on the global growth and on the inflation in generally appear very conflicting for this reason the numbers one of the central banks have not wanted to go ahead .

During this week has been introduced the fiscal reform from the Trump’s Government.

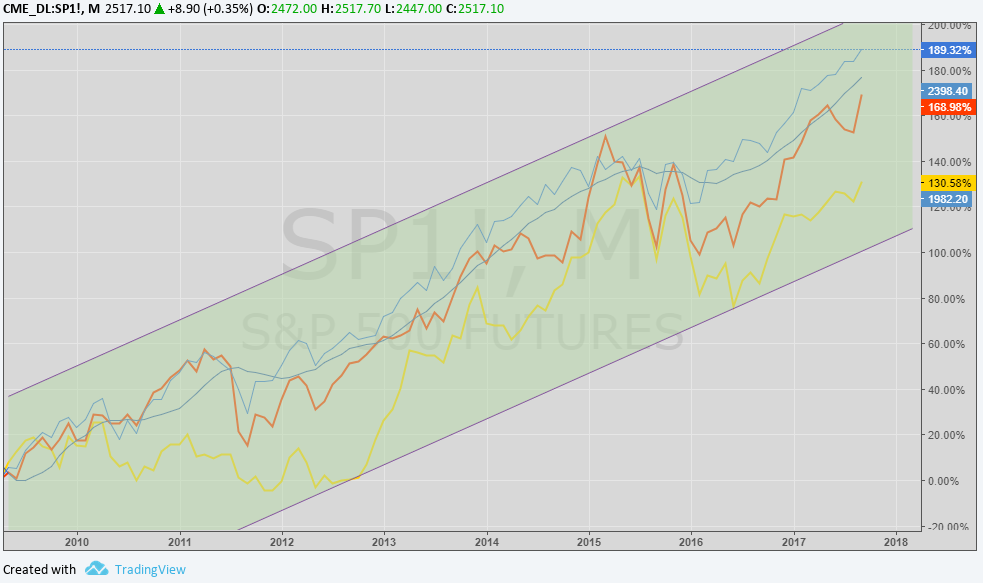

The text, still temporary (8 deprived pages of details meanings), leaves many doubts around the probability that is going to be approved by the Congress, both on the plan of the economic sustainability. In fact, as a study of the Tax Policy Center notice (think tank independent situated in Washington) to draw the greatest benefits from the reform it would be the 1% of the richest band of the population (or rather those people which perceived income higher than $ 300,000 a year). The cost for the first 10 years would amount at $ 2.4 trillion and would rise to $ 3.2 trillion for the second decade of implementation. The text, which had already arrived to the press shortly before the official presentation, had surprised the markets, initially triggering strong sales on stock quotes. But, once again, the downward correction was seen by operators as another opportunity to buy by bringing lists not only to recover the fall, but also to point to the upside some major psychological resistance: currently the S & P500 index is found down to 2,520 points, Russell 3000 at 1,495 points and Dow Jones to 22,405 points.

Great performance also for European charts: DAX 30 reached 12,828, FTSEMIB 22,696, Spanish IBEX-35 10,381 and CAC-40 5,329 points. Following above figures, it is quite clear that despite the disappointing outcome of the German elections and the crisis that Spain is currently facing due to the strong tensions with Catalonia, the markets are undergoing a strong "bull" phase. News with a potentially negative impact is systematically ignored or underestimated; on the opposite , any vaguely positive news is amplified and taken as a starting point for making new records.

Graphic: S&P500 (red), Dax (blue), Nikkei (yellow).

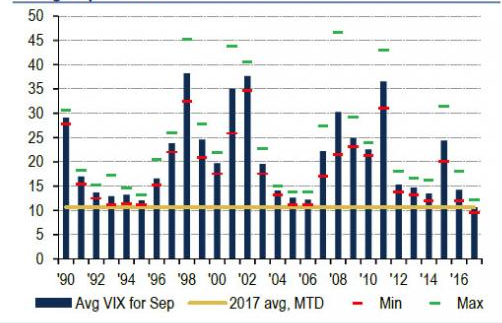

About the records , also the index VIX (which measure the implicit volatility, that is future of the index S&P500) has seen the month of September as the ones having the lower historical average, as a 10,60.

As a conclusion of the summary of the week marked from record, underlines, as in the last days the palladium is coming rated to superior prices in comparison to the platinum (which, although is apparently an anomalous fact, can’t surprise: the registrations of gasoline auto in Europe to 15 has surpassed the registrations of auto to diesel and the palladium is the metal mostly adopted in the systems of unloading of the gasoline cars.

The average VIX level for September 2017 was the lowest ever recorded.

Source: ZeroHedge, BoFA Merryll Linch Global Research. Data from January 2, 1990 to September 27, 2017.

Gold (XAUUSD)

Third consecutive weeks of rebates for the yellow metal. The fiscal reform of the President Trump and the interventions of the number one of the FED Janet Yellen have put the quotations under pressure. In this moment the metal has lost 150 dollars from the rally who had started in the month of July and the rebound of the beginning of the week instigated from the geopolitical tensions has immediately been absorbed. If the dollar will keep on growing stronger because of the above-mentioned reasons, the quotations of the gold could go to test the 1250 dollars per ounces in the brief term and the 1200-1210 in the middle. Wear down the chances to pierce the historical resistance at 1375 dollars per ounces.

Weekly Graphic XAUUSD (main supports and resistances)

To the daily level, the gold is going around 1280 $ /oz.s Such level of price could offer a solid base for a possible new starting. Nevertheless, if the run to the rebate had to continue, in the center we would find a transitory support at 1270 dollars before and subsequently 20 more dollars in low to 1250% /oz.s

Weekly Graphic XAUUSD (supports and resistances in blue/red)

Silver (XAGUSD)

The silver as the gold, continuous to accuse the rise of the dollar. Currently the metal is supported to the strong support offered by the level set to 16,65 dollars per ounces. If the price continues to go down , the first supports are found in area 16,50. 16,35 and subsequently to 16,10 $ /oz.s Nevertheless, both for the gold as for the silver, it is possible that the effects of the referendum on the independence of the Catalogna and on the new Merkel’s government in the street of constitution has not fully been still quoted in the market from the market. Such elements of political uncertainty could be the future drivers for a vigorous rebound of the quotations.

Weekly Graphic XAGUSD (main supports and resistances)

PLATINUM (XPTUSD)

Third week of heavy decreases also for the quotations of the platinum. The price as already been underlined in the last weekly reports has broken the channel of growth formed from half July. The support at 930 $ / oz has been and currently the quotations of the metal travel toward the area 910-912 $ /oz.s We remember nevertheless that:

- the second producer of the world of platinum, Impala Platinum, is facing different strikes because of the thousands of probable looked out upon by the management following the brought losses last fiscal year. This could bring to a diminution of the production.

- the metal, whose quotations are for the first time in 15 years lower in comparison to those of the palladium (and obviously also for the gold) could begin to attract the operators of the jewels sector with a consequent increase of the question.

Grafico settimanale XPTUSD (main supports and resistances)

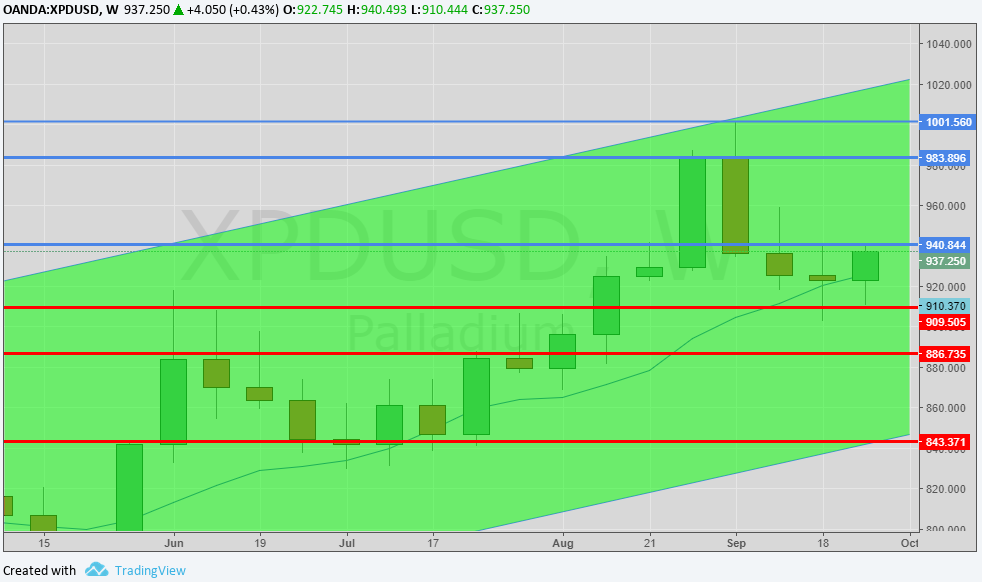

PALLADIUM (XPDUSD)

Unlike from the gold, silver and platinum, the last week has been positive for the palladium. The metal has bounced from the support in area 910-915 (maximum of the 2014) and is stopped near the resistance posts at 940 $ /oz. The driver of growth has been furnished by the recent data on the registrations of cars in Europe which have seen the passing of the vehicles to gasoline towards those fed to diesel. The fundamental ones continue therefore to supporting although , as the Commerzbank notice , the too elevated quotations relatively of the metal combined to discounted price of the platinum could induce the producers to employ this last in the construction of gasoline catalysts.

Weekly Graphic XPDUSD (main supports and resistances)

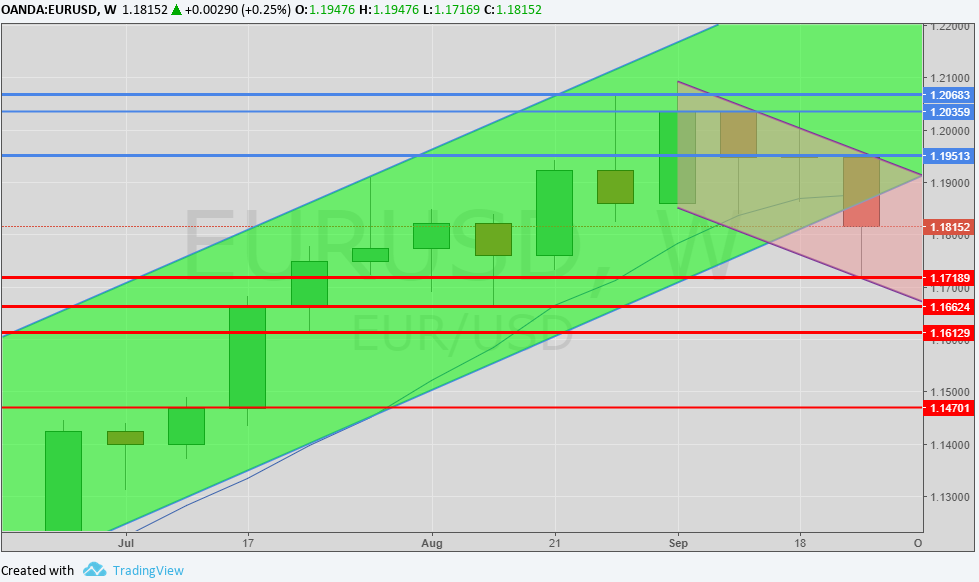

EURODOLLARO (EURUSD)

The change has broken the channel of growth and has made a will to the area behind 117. The currency of the eurozona has immediately lost strength after the election of Angela Merkel and you/he/she is subsequently weakened after the words pronounced by Janet Yellen I concern the forward guidance of the FED. If the political uncertainty on the European ground had to whet him the unique currency you/he/she could continue the phase bear in area 1,15-116.

Weekly Graphic EURUSD (main supports and resistances)

…in summary

|

ORO |

Resistances |

1290 |

1310 - 1350 |

|

Supports |

1280 |

1250 - 1260 |

|

ARGENTO |

Resistances |

17,25 |

17,70 |

|

Supports |

16,10 - 16,15 |

16,65 |

|

PLATINO |

Resistances |

1032 |

1045 - 1050 |

|

Supports |

960 |

980 - 986 |

|

PALLADIO |

Resistances |

940 |

985 - 1000 |

|

Supports |

910 - 912 |

900 |

|

EURUSD |

Resistances |

1,18 - 1,20 |

1,25 |

|

Supports |

1,15 - 1,16 |

1,175 |

Sources: Bloomberg, Commerzbank, Reuters, ScotiaBank, UBS, BoFA Merrill Lynch, Zerohedge.

IT

IT  ES

ES