Price of gold in 2022: The three key factors

Price of gold in 2022: The three key factors

After the 2018-2020 Rally which saw prices rise by about 78%, in 2021 there was a consolidation of the gold price: in the last article "Gold Prospects 2022" we saw how in the first 6 months of gold took on a timid trend, and then spiked in the second part - in the wake of the rapid spread of the Omicron variant - closing at 1806 $ / oz.

According to analyzes reported in the LBMA Annual Precious Metals Survey, 2022 promises to be a year with many cross-currents.

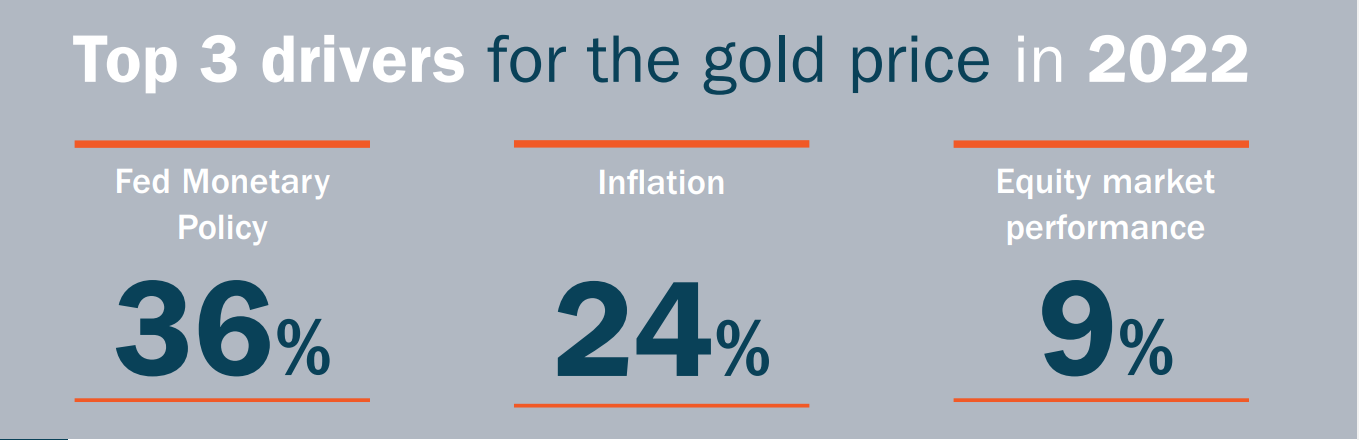

The survey reports the testimonies of several analysts about the prospects for the gold trend in 2022. It is therefore possible to identify three main factors driving the price:

the Fed's monetary policy, with expected interest rate hikes;

concerns about inflation;

stock market trend;

As factors, COVID-19 and geopolitical tensions follow (although surprisingly they were not particularly considered as key influences on a par with the above for the price in 2022).

Source: LBMA Annual Precious Metals Forecast Survey

While the geopolitical tensions over Russia and Eastern Europe and the potential flare-up of the China / Taiwan conflict could increase the demand for gold given its safe-haven nature, on the other hand, the increase in the inflation rate - driven by pressure on the supply chain - generated conflicting opinions.

On the one hand, there are those who consider inflation a factor driving the price of gold given the stimulus given to investors, who would be inclined to invest in the yellow metal to preserve purchasing power.

On the other hand, there are those who see inflation itself as a limit, since any "corrective" monetary policies of central banks could increase the opportunity cost of holding gold and therefore be a headwind.

In this scenario, investors could achieve greater returns by buying other assets (such as stocks or bonds) or by leveraging expected bank interest rates by leaving money on deposit.

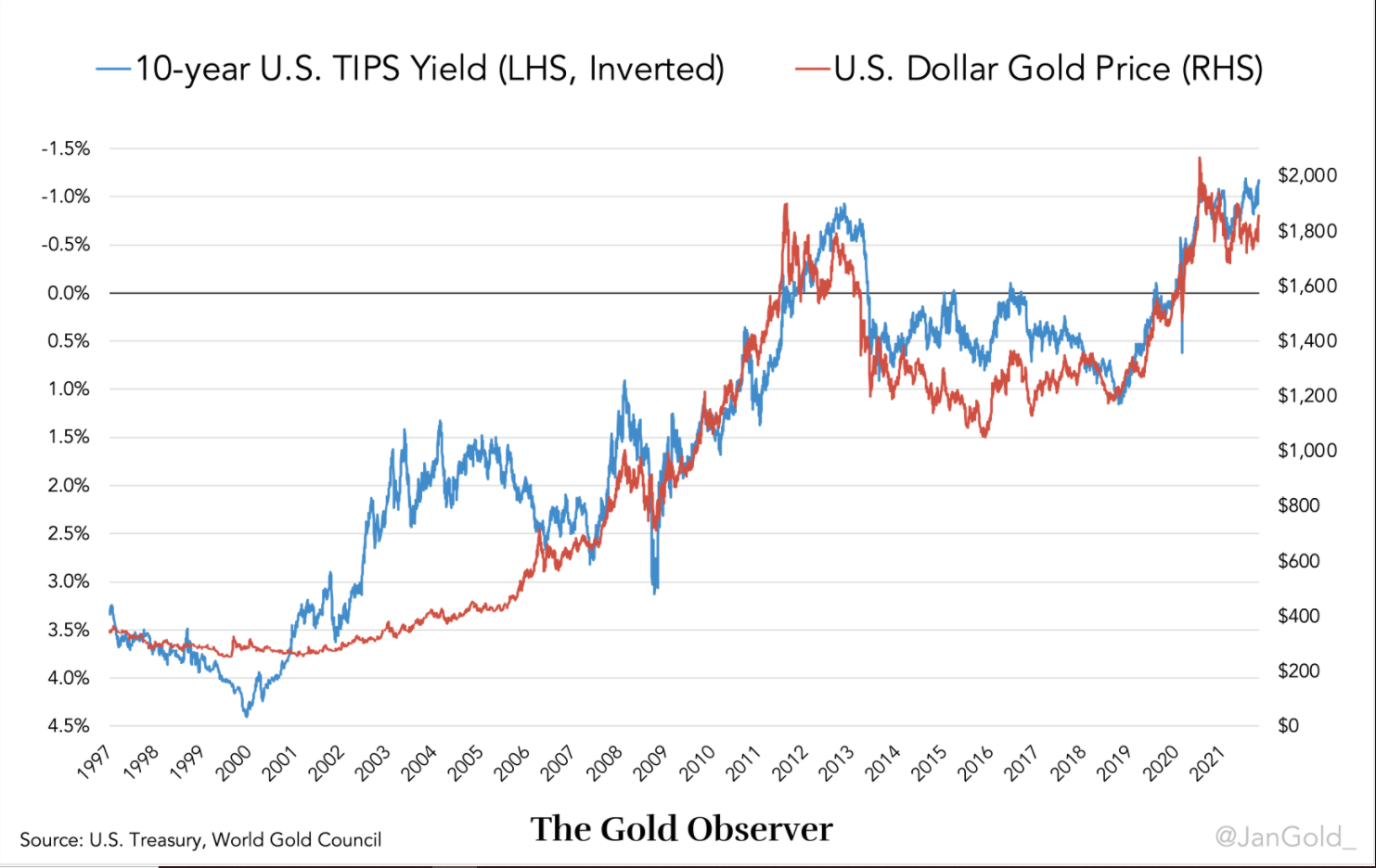

In fact, looking at the time series below, we see how since 2006 the price of gold in US dollars has been inversely correlated with the (expected) real interest rates derived from the US 10-year Treasury Inflation Protected Security (TIPS):

Source: The Gold Observer, World Gold Council

From the chart we see that when the TIPS rate falls, the price of gold rises and vice versa. The reasoning is that when the real interest rate on government bonds falls, it becomes more attractive to own gold, because gold is the only international reserve asset with no counterparty risk. When the real interest rate increases, it becomes less interesting to own gold, since the yellow metal does not pay / does not accrue interest on it, but I can earn it by reselling it at a higher price by exploiting the price changes over a certain time horizon.

According to analysts, the crux lies in the attitude that investors will take: trust in bonds would extinguish risks, with gold prices that could therefore tend to decline after the exceptional performance in recent years. Conversely, the climate of uncertainty - which at the moment seems to be taking on a lasting trait - would probably create a bullish environment for the yellow metal: government deficits, increased public and private debt should support the price of gold. At the same time, geopolitical tensions between the United States and China or more violence in Ukraine or Kazakhstan could trigger a race to the safe haven, increasing the demand for gold and therefore its price. Furthermore, Fastmarkets analysts find it difficult for central banks to put themselves in a position to raise interest rates to the extent necessary to stem inflation.

Despite this, according to Jonathan Butler, an analyst at the London-based Mitsubishi Corporation, the increase in real interest rates by the Fed would still be inevitable in 2022. The appeal of gold would thus be affected. This condition could decrease the physical demand for the metal, with a price that will lend greater volatility.

However, the emergence of new Covid variants arriving in the midst of an irregular vaccination system would continue to keep investors on the defensive, prompting them to re-allocate portfolios in a more conservative sense. State of affairs that would put gold back into potential advantage.

Sources:

LBMA Annual Precious Metals Forecast Survey

Jonathan BUTLER Mitsubishi Corporation (LBMA Annual Precious Metals Forecast Survey)

Robin Bhar Metals Consulting (RBMC), (LBMA Annual Precious Metals Forecast Survey)

William ADAMS Fastmarkets, (LBMA Annual Precious Metals Forecast Survey)

The Gold Observer

IT

IT  ES

ES