Weekly Italpreziosi Report – August 21-25

Weekly Italpreziosi Report – August 21-25

Report settimanale 21-25 Agosto

Flat calm on the markets this week: the polemics about Charlottesville’s facts are damped as the tensions between the United States and North Korea. All the attentions are for the annual symposium of the Federal Reserve at Jacksone Hole. Two days beginning (from Friday 25 August) where the most important central bankers will discuss on the actual state of health of the global economy. Obviously the interventions which are considerate from the analysts as the most Important will be those of the FED and of the BCE numbers one, Janet Yellen and Mario Draghi.

What we can except from the meeting?

This time the meeting could be very different from the past , there won’t be such announcements to upset the markets. The BCE has already said that( by using indirect ways)that Draghi won't make any references to the tapering while, from the Usa side, many agree that the Yellen’s announce will be more or less similar to those made recently, about the importance of the financial stability. In practice, nothing new under the sun. Seth Carpenter ‘s advice (economist to UBS about the meeting sounds like this : "it won't be said anything to be worth jumping the lunch." Of the same idea are Deutsche Bank and ING.

The marketplace

The absence of relevant news both from the economic side and from the political side has damped the volatility on the markets that have started over dozing waiting for some important drivers. Stock indexes, metals and currencies have gravitated on the levels of last week moving in limited range. The s & P500 always travels on the maximum while the gold and the silver stay behind (respectively 1300 $ / oz and 17,20-50 $ / oz) resistances. Also the change eurodollar remains in the area 1,17-118.

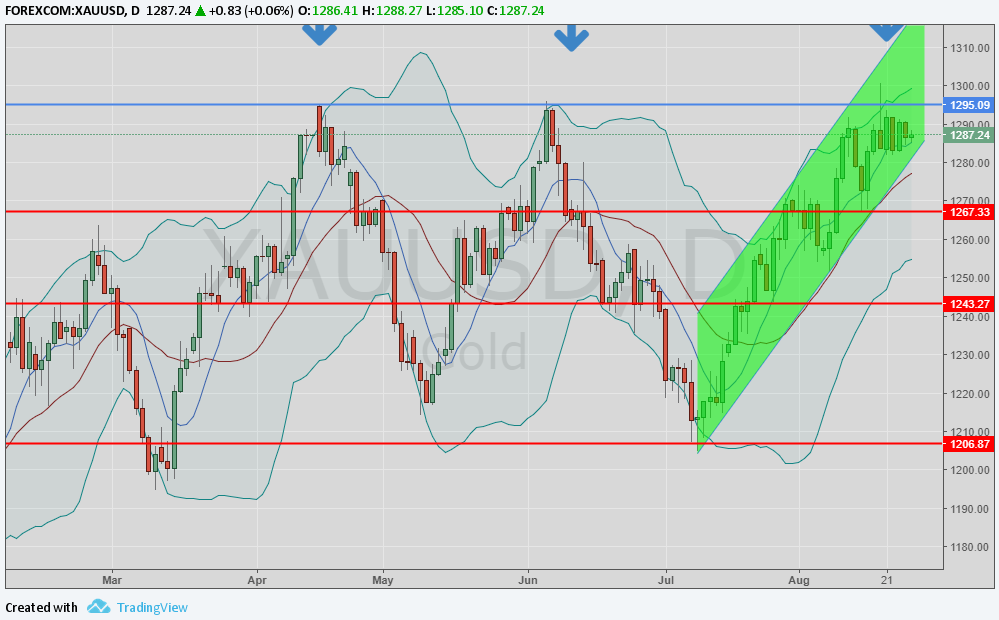

Gold (XAUUSD)

The yellow metal fails upward for the third time in few months the breakup of the area 1295-1300 $ although continuous to remain above the averages to 55,100 and 200 days. As already affirmed in the last report the outlook of long term it is constructive: nevertheless to be confirmed need a weekly closing above the 1295 $ /oz.s Only in this the price could push toward the maximum touched in July of l the last year to quota 1375 dollars. If won’t go as mentioned the price finds its first supports at 1285-1280 $ / oz and after in area 1270, 1240 -1250. $ /oz.

Daily graphic XAUUSD (principles supports and resistance)

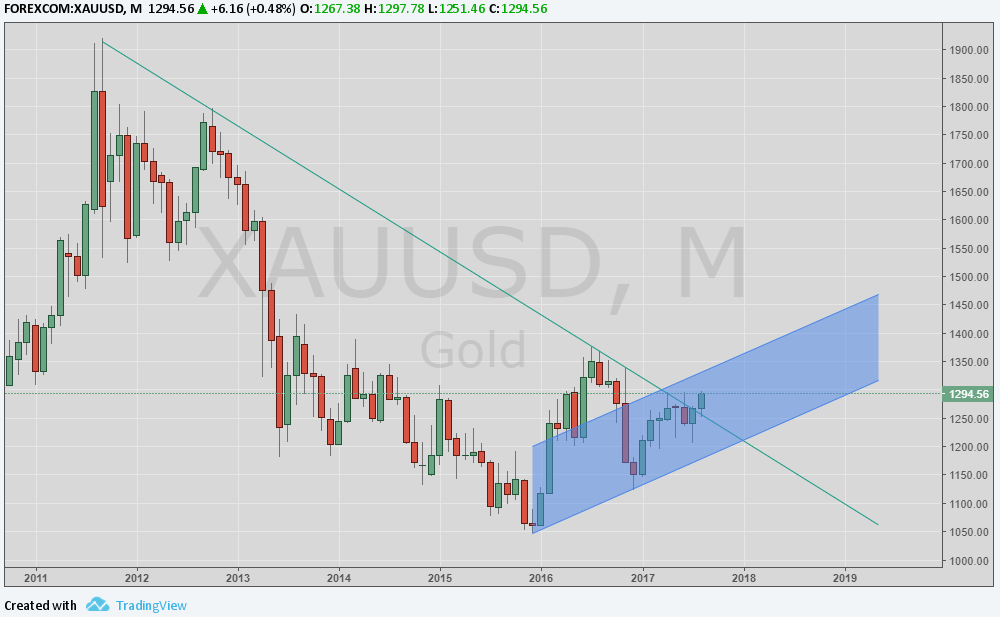

The outlook of this long period still positive (as already said in the last weekly report the price has succeeded in breaking down to the rise an historical trendline, see the graphic ). This signal could represent a trend inversion of a long period. The reentry in the channel of of the decline could be on the contrary, caused a movement to a violent decrease.

Monthly report XAUUSD (principles supports and resistance)

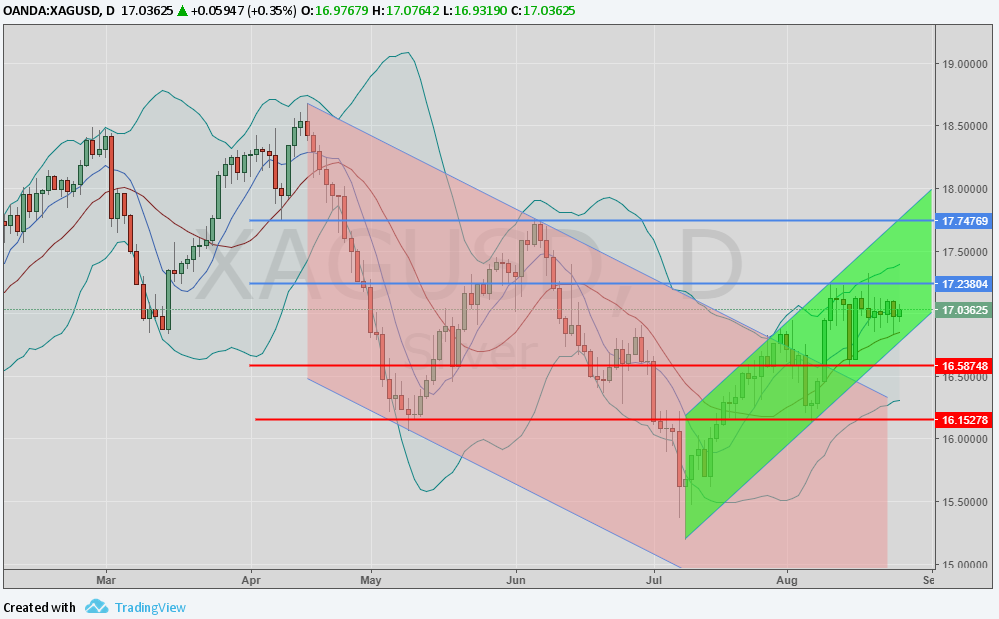

SILVER(XPTUSD)

The price of the silver still the same: the metal has oscillated for all the week in a range of few cents, however always around the mobile average to 200 days (currently in area 17020). A rush to the rise could push the metal toward the 17,80 $ / oz (maximum relative of period). Such level key, if broken, could bring to an increase in area 18,70 $ / oz (maximum of April). On the contrary and in lack of strong driver the price could sufficiently, reenter in ancrease channel(you see graphic) toward new minimum

Graphic XAGUSD (principles supports and resistance)

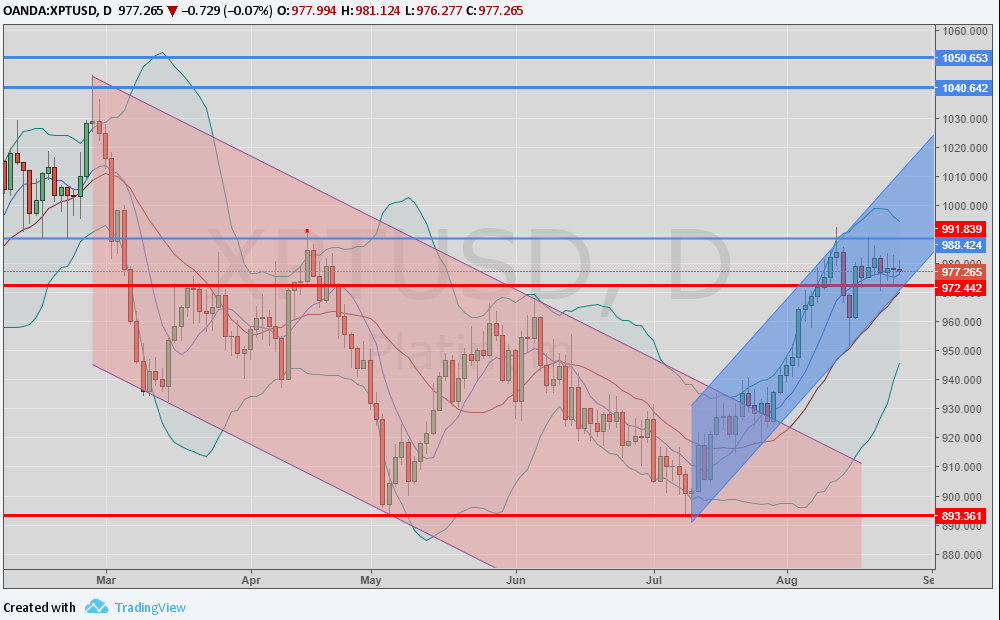

PLATINUM (XPTUSD)

The outlook of a long period is neutral-positive. The metal has confirmed in more than one occasion to have a solid support in area 890 $ / oz (minum of December 2016) and it seems to continue the run to the rise. Signals of strength are given by the numerous closings above the resistance above the 972 $ /oz.s The next target to the rise is represented by the 990 dollars: broken this level the metal could push in area 1040 $ / oz before and, and later, in area 1050 $ /oz.s

Graphic XPTUSD (principles supports and resistance)

Palladium (XPDUSD)

Among the metals the palladium continues to be the most promising. The price has broken both the resistance place at 911 dollars per ounce (maximum of the 2014) and the ones more recent place at 914 $ / oz touching the 940 $ /oz.s It is not exclude a further run to the rise, also supported to good fundamental (increasing question of physical metal against a scarce offer).

Graphic XPDUSD (principles supports and resistance)

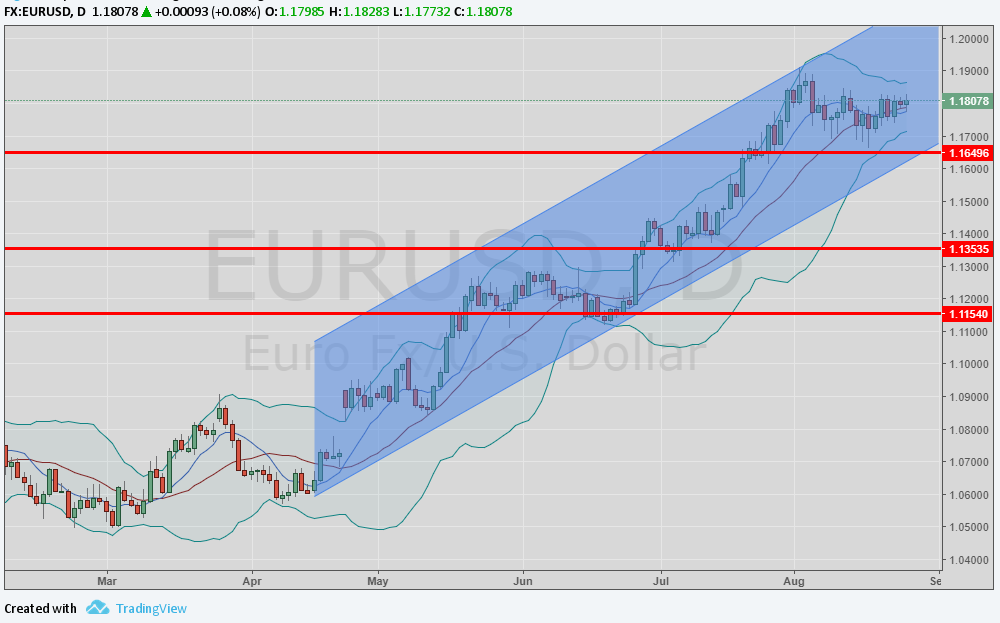

EURODOLLARO (EURUSD)

The exchange has been set up for different days in the range 1,17 - 1,1750 -18. For the currency of the eurozona the outlook still neutral-positive (otherwise from the expectations.it is not to exclude an approach toward 1,20 in the case in which slips out. some news about the tapering from the BCE). The dollars still heavy (over not so bright data on the USA economy) from the mistrust for the missed reforms promised by the Trump administration.

Graphic EURUSD (principles supports and resistance)

…In brief

|

GOLD |

Resitenze |

1295,1300 |

1350,1375 |

|

Supporti |

1229 |

1250 |

|

SILVER |

Resistenze |

17,10 |

17,60 |

|

Supporti |

15,30 |

15,60; 16,00 |

|

PLATINUKM |

Resistenze |

995 |

1045,1050 |

|

Supporti |

900 |

913, 915 |

|

PALLADIUM |

Resistenze |

911,915 |

950 |

|

Supporti |

830,835 |

860 |

|

EURUSD |

Resistenze |

1,1800 |

1,1880 |

|

Supporti |

1,1150 |

1,1350 |

Fonti: Bloomberg, Commerzbank, MPS Capital Services, Mitsubishi Corporation International, UBS.

Finito di redigere alle 14:30 di venerdì 25 agosto 2017.

IT

IT  ES

ES