Silver hits 14-year high: solid position above $43.50

Silver hits 14-year high: solid position above $43.50

The week started with a strong rally for silver, which on Monday, September 24, 2025, opened trading sessions on a sharp upward trajectory. The next resistance level is set at $44.87, while the first technical support is seen at $42.45.

Growing demand for safe-haven assets and gold firmly above €100 per gram are pushing investors toward silver, reinforcing its upward trend.

The Fed and Global Tensions

The demand for defensive assets is increasing amid growing geopolitical instability. Russian airstrikes in Ukrainian territory continue unabated, while the interception of Soviet-era jets in European airspace raises fears of a potential escalation in the conflict.

Tensions are also mounting in the Middle East, as the United Kingdom, Canada, Australia, and Portugal have officially recognized the State of Palestine, joining over 140 countries supporting the two-state solution. This move risks creating significant diplomatic friction with Israel, a long-standing ally of Western nations, further contributing to an atmosphere of uncertainty.

On the economic front, the more dovish monetary policy adopted by the U.S. Federal Reserve is supporting silver. Last week, the Fed cut interest rates by 25 basis points — a move typically favorable to precious metals.

Further rate cuts are expected before year-end, possibly even up to 50 basis points, which would continue to support high valuations for safe-haven assets.

Silver: From Jewelry to Strategic Programs

Over time, silver has been transitioning from a predominantly cyclical commodity (jewelry, electronics, investment) to a preferred material in long-term, structural programs such as AI data centers, energy infrastructure, and defense modernization.

If silver is indeed moving away from short economic cycles to being employed in long-term projects backed by government budgets, the metal’s risk profile could change significantly, shifting investor focus toward medium- and long-term positioning.

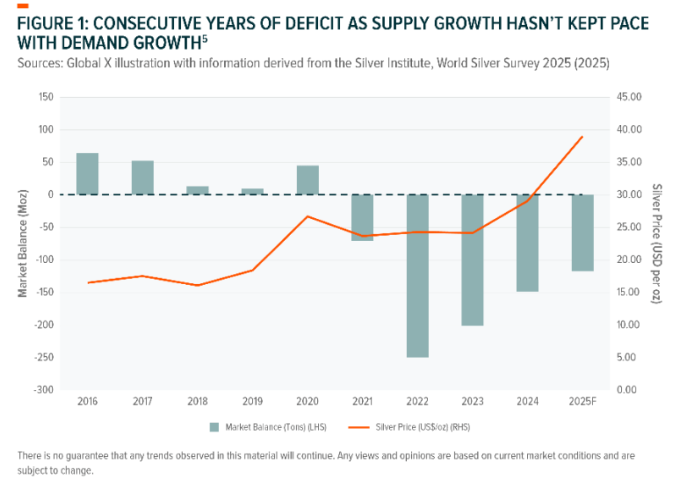

Meanwhile, sourcing silver is becoming increasingly challenging. In 2024, the market recorded its fourth consecutive structural deficit, at a time when industrial demand reached a new all-time high.

The following chart clearly shows the pressure on supply, which since 2021 has struggled to keep pace with steadily rising demand.

Why Invest in Silver

While often overshadowed by gold, silver continues to gain traction. In fact, not everyone realizes that in 2025, silver has outperformed its more famous counterpart: with a year-to-date gain of approximately 47%, silver has surpassed gold’s 41% rise over the same period.

Unlike gold, which is mainly regarded as an investment asset, silver is heavily used in industrial applications, accounting for over 50% of total demand. The ongoing energy transition may play a decisive role in this growing demand, which has now marked its fifth consecutive year of supply deficit.

Silver’s accessible price point makes it an appealing option for a wide range of investors, offering easy and affordable access to a market increasingly shaped by structural trends and long-term strategic shifts.

Fonti:

IT

IT  ES

ES