THE RISK OF BREXIT FOR THE MARKETS

THE RISK OF BREXIT FOR THE MARKETS

The latest polls see the advocates for the United Kingdom to stay in the European Union taking the lead.

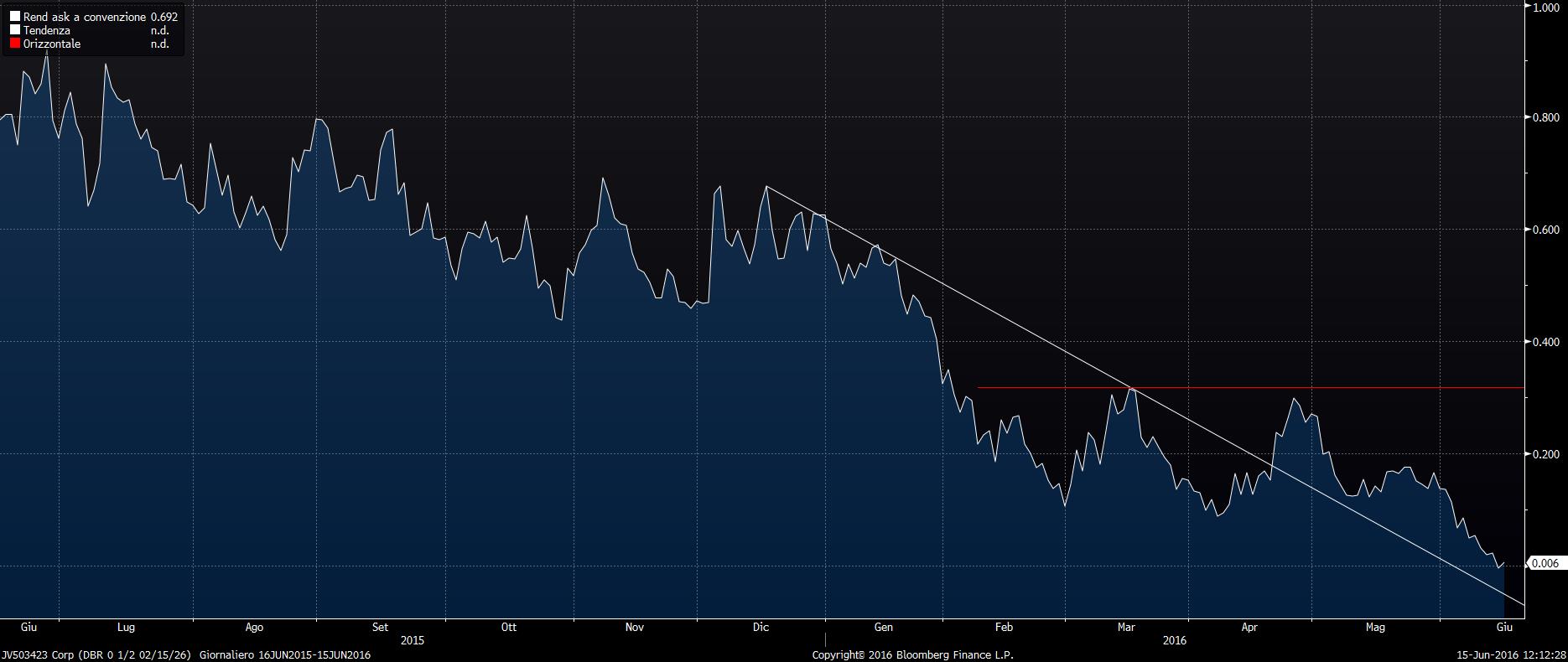

The investors, uncertain and frightened by the possible consequences of the referendum, are taking refuge on assets such as precious metals and bonds like the German Bund (with the rate fell negatively) or the American t-note are considered safer.

It’s difficult to predict the outcome of the referendum and the scenarios that will be opened in the event of the success of the Brexit. To confirm this, BCE experts are preparing themselves not for a single shock, but for a series of shocks over time.

Brexit could mean the beginning of a phase of disintegration of the EU, as other countries may follow Great Britain on the matter, leading to a possible phase with advanced political uncertainty coming from the euro-skeptics in some key states.

Following this scenario, the markets are starting to price a possible adverse event with the volatility that is actually rising, meaning massive sales on the stock markets and generally more risky assets, while purchases are focusing on safe-haven assets : Gold, Silver and bonds .

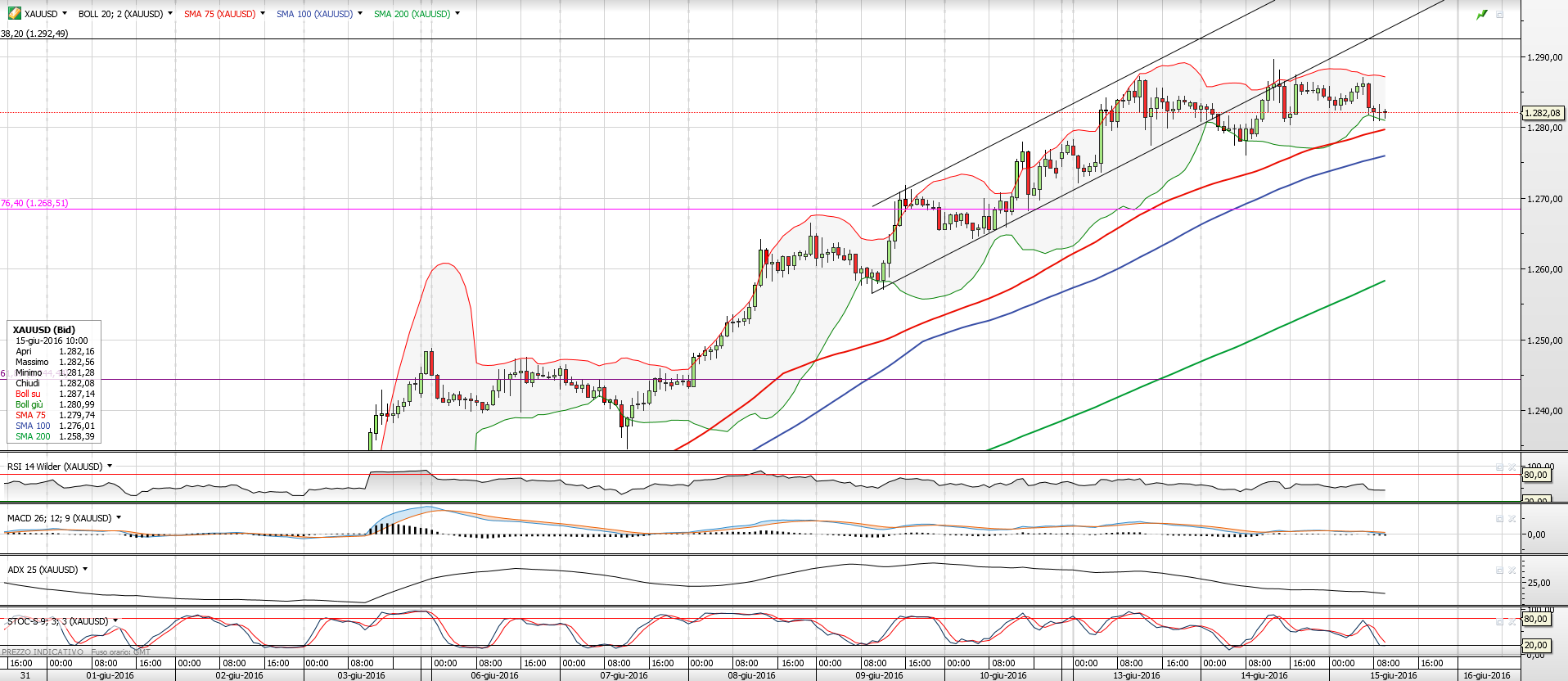

Let’s see technically the setting of such assets.

The gold graphic layout is still on the side in the medium term. The channel that runs from 1,200 $/oz to 1,300 $/oz has been harnessing the prices while waiting for a directional signal that could arrive thanks to the result of the referendum in Britain. Regarding a possible increase the levels to be monitored if the channel was broken are respectively 1,350 $/oz before and 1,400 $/ oz after . However, in case of a downside, if the referendum were to give a negative result, meaning the UK is to remain in the EU, the first relevant support is at 1,250 $/oz, and if it should break then the courses could head to the threshold of 1,200 $/oz.

Silver is showing less strength than its noble cousin, because it’s nature of safe-haven asset is not as much important as gold, and because its macroeconomic ups and downs all around the world. The resistance and support levels are respectively around area 17.8/18 $/oz and 16.8 /16.5 $/oz.

The rate of German bund updated its historic lows with a -0.005, going negative for the first time in history. This is symptomatic of how investors are looking for safety and how they are also willing to pay for storing their liquidity.

Edoardo Biagini

IT

IT  ES

ES